All News

-

SOI Tax Stats - Filing Season Statistics

Our filing season statistics present data from all Forms 1040 processed by the IRS at three critical points during the year: late May, mid-July, and mid-November.

The late-May filing season statistics by adjusted gross income (AGI) summarize the data from all individual income tax returns filed with the IRS by late May. These tables primarily reflect income earned in the year preceding the filing year, and reported to the IRS by the April 15 filing deadline. These data exclude taxpayers who requested a 6-month filing extension by filing Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return. The data represent approximately 90 percent of all returns that will be processed by the IRS in the calendar year. Because taxpayers who request an extension generally have more complex finances, on average, the data reflect 84 percent of the total AGI and 80 percent of the total tax liability that will be reported for all individual income tax returns filed during the year.

Statistics from returns processed by mid-July update the data from the late-May filing season statistics. These statistics represent approximately 95 percent of all individual filers, 87 percent of total AGI, and 82 percent of total tax liability.

Data in the last set of tables, the mid-November filing season statistics by AGI, reflect nearly all individual income tax returns that will be received and processed in the calendar year, including any returns filed by the April 15 deadline and granted a 6-month extension.

These filing season statistics are presented in two sections.

First section: Expanded tables present data for selected sources of income, deductions, credits, and taxes for returns filed for the prior tax year.

Second section: Includes distributional data for AGI, income tax after credits, and the share of income from the sale of capital assets for returns filed for the prior tax year and some late-filed returns for earlier tax years.

Filing Season Statistics

The statistics present data from the population of all Forms 1040 processed in Calendar Year 2018 for Tax Year 2017. Data are presented for select sources of income, deductions, credits, and individual income taxes. The tables are classified by AGI classifications. Data represent the three critical points in the annual filing season and form a baseline for comparison of year to year trends.

Late-May Filing Season Statistics by AGI

These tables present data from the population of all Forms 1040 processed by the IRS on or before week 21 of the calendar year. Returns filed reflect income earned in the year preceding the filing year, but exclude taxpayers who requested a 6-month filing extension by filing Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return.

2018 2019 2020 2021*

* Due to the new filing deadline for 2021 and delays in return processing caused by the Covid-19 pandemic, for 2021 data are presented for returns filed on or before week 26 (end of June) instead of week 21.

Mid-July Filing Season Statistics by AGI

These tables present data from the population of all Forms 1040 processed by the IRS on or before week 30 of the calendar year. Returns filed reflect income earned in the year preceding the filing year, but exclude taxpayers who requested a 6-month filing extension by filing Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return.

2018 2019 2020 2021

Mid-November Filing Season Statistics by AGI

These tables present data from the population of all Forms 1040 processed by the IRS on or before week 47 of the calendar year. Returns filed reflect income earned in the year preceding the filing year.

2018 2019 2020*

* Due to delays in return processing caused by the Covid-19 pandemic, for 2020 data are presented for returns filed on or before week 53 (late-December) instead of week 47.

Distributional Data Presented for Adjusted Gross Income, Income Tax After Credits, and Share of Income From Sales of Capital Assets

These data have been developed as part of a research program to provide authoritative data for use by researchers that would avoid the inaccuracies that may occur by using incomplete data. The statistics primarily represent income earned in the prior year, but will include some late-filed returns for earlier tax years.

The final column in each table indicates the share of income from the sale of capital assets represented in the income presented. By comparing the data presented in these tables over time, they can be used to develop early estimates of changes in the economy or to update forecasts of economic activity that were developed using older data.

Late-May Statistics by AGI

These tables present information from the population of all Forms 1040 processed by the IRS on or before week 21 of the calendar year. Returns filed primarily reflect income earned in the year preceding the Filing Year, but exclude taxpayers who requested a 6-month filing extension by filing Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return.

2010 2011 2012 2013 2014 2015 2016 2017 2018

Mid-July Statistics by AGI

These tables present information from the population of all Forms 1040 processed by the IRS on or before week 30 of the calendar year. Returns filed primarily reflect income earned in the year preceding the Filing Year, but exclude taxpayers who requested a 6-month filing extension by filing Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return.

2010 2011 2012 2013 2014 2015 2016 2017 2018

Mid-November Statistics by AGI

These tables present information from the population of all Forms 1040 processed by the IRS on or before week 47 of the calendar year. Returns filed primarily reflect income earned in the year preceding the Filing Year.

Source :

https://www.irs.gov/statistics/filing-season-statistics

US TAX, U.S. TAXSOI Tax Stats - Filing Season Statisticsmore -

Taxpayers can protect themselves from scammers by knowing how the IRS communicates

If the IRS does call a taxpayer, it should not be a surprise because the agency will generally send a notice or letter first. Understanding how the IRS communicates can help taxpayers protect themselves from scammers who pretend to be from the IRS with the goal of stealing personal information.

Here are some facts about how the IRS communicates with taxpayers:

The IRS doesn't normally initiate contact with taxpayers by email. Do not reply to an email from someone who claims to be from the IRS because the IRS email address could be spoofed or fake. Emails from IRS employees will end in IRS.gov.

The agency does not send text messages or contact people through social media. Fraudsters will impersonate legitimate government agents and agencies on social media and try to initiate contact with taxpayers.

When the IRS needs to contact a taxpayer, the first contact is normally by letter delivered by the U.S. Postal Service. Debt relief firms send unsolicited tax debt relief offers through the mail. Fraudsters will often claim they already notified the taxpayer by U.S. Mail.

Depending on the situation, IRS employees may first call or visit with a taxpayer. In some instances, the IRS sends a letter or written notice to a taxpayer in advance, but not always. Taxpayers can search IRS notices by visiting Understanding Your IRS Notice or Letter. However, not all IRS notices are searchable on that site and just because someone references an IRS notice in email, phone call, text, or social media, does not mean the request is legitimate.

IRS revenue agents or tax compliance officers may call a taxpayer or tax professional after mailing a notice to confirm an appointment or to discuss items for a scheduled audit. The IRS encourages taxpayers to review, How to Know it's Really the IRS Calling or Knocking on Your Door: Collection.

Private debt collectors can call taxpayers for the collection of certain outstanding inactive tax liabilities, but only after the taxpayer and their representative have received written notice. Private debt collection should not be confused with debt relief firms who will call, send lien notices via U.S. Mail, or email taxpayers with debt relief offers. Taxpayers should contact the IRS regarding filing back taxes properly.

IRS revenue officers and agents routinely make unannounced visits to a taxpayer's home or place of business to discuss taxes owed, delinquent tax returns or a business falling behind on payroll tax deposits. IRS revenue officers will request payment of taxes owed by the taxpayer. However, taxpayers should remember that payment will never be requested to a source other than the U.S. Treasury.

When visited by someone from the IRS, the taxpayers should always ask for credentials. IRS representatives can always provide two forms of official credentials: a pocket commission and a Personal Identity Verification Credential.

Source :

https://www.irs.gov/newsroom/taxpayers-can-protect-themselves-from-scammers-by-knowing-how-the-irs-communicates

US TAX, U.S. TAXTaxpayers can protect themselves from scammers by knowing how the IRS communicatesmore -

Retirement and taxes: Understanding IRAs

Individual Retirement Arrangements, or IRAs, provide tax incentives for people to make investments that can provide financial security for their retirement. These accounts can be set up with a bank or other financial institution, a life insurance company, mutual fund or stockbroker.

Here's a basic overview to help people better understand this type of retirement savings account.

Contribution. The money that someone puts into their IRA. There are annual limits to contributions depending on their age and the type of IRA. Generally, a taxpayer or their spouse must have earned income to contribute to an IRA.

Distribution. The amount that someone withdraws from their IRA.

Withdraws. Taxpayers may face a 10% penalty and a tax bill if they withdraw money before age 59 ½, unless they qualify for an exception.

Required distribution. There are requirements for withdrawing from an IRA:

Someone generally must start taking withdrawals from their IRA when they reach age 70½.

Per the 2019 SECURE Act, if a person's 70th birthday is on or after July 1, 2019, they do not have to take withdrawals until age 72.

Special distribution rules apply for IRA beneficiaries.

Traditional IRA. An IRA where contributions may be tax-deductible. Generally, the amounts in a traditional IRA are not taxed until they are withdrawn.

Roth IRA. This type of IRA that is subject to the same rules as a traditional IRA but with certain exceptions:

A taxpayer cannot deduct contributions to a Roth IRA.

Qualified distributions are tax-free.

Roth IRAs do not require withdrawals until after the death of the owner.

Savings Incentive Match Plan for Employees. This is commonly known as a SIMPLE IRA. Employees and employers may contribute to traditional IRAs set up for employees. It may work well as a start-up retirement savings plan for small employers.

Simplified Employee Pension. This is known as a SEP-IRA. An employer can make contributions toward their own retirement and their employees' retirement. The employee owns and controls a SEP.

Rollover IRA. This is when the IRA owner receives a payment from their retirement plan and deposits it into a different IRA within 60 days.

Source :

https://www.irs.gov/newsroom/retirement-and-taxes-understanding-iras

US TAX, U.S. TAXRetirement and taxes: Understanding IRAsmore -

What people should and should not do if they get mail from the IRS

Every year the IRS mails letters or notices to taxpayers for many different reasons. Typically, it's about a specific issue with a taxpayer's federal tax return or tax account. A notice may tell them about changes to their account or ask for more information. It could also tell them they need to make a payment. This year, people might have also received correspondence about Economic Impact Payments or an advance child tax credit outreach letter.

Here are some do's and don'ts for anyone who receives mail from the IRS:

Don't ignore it. Most IRS letters and notices are about federal tax returns or tax accounts. Each notice deals with a specific issue and includes specific instructions on what to do

Don't throw it away. Taxpayers should keep notices or letters they receive from the IRS. These include adjustment notices when an action is taken on the taxpayer's account, Economic Impact Payment notices, and letters about advance payments of the 2021 child tax credit. They may need to refer to these when filing their 2021 tax return in 2022. In general, the IRS suggests that taxpayers keep records for three years from the date they filed the tax return.

Don't panic. The IRS and its authorized private collection agencies do send letters by mail. Most of the time, all the taxpayer needs to do is read the letter carefully and take the appropriate action.

Don't reply unless instructed to do so. There is usually no need for a taxpayer to reply to a notice unless specifically instructed to do so. On the other hand, taxpayers who owe should reply with a payment. IRS.gov has information about payment options.

Do take timely action. A notice may reference changes to a taxpayer's account, taxes owed, a payment request or a specific issue on a tax return. Acting timely could minimize additional interest and penalty charges.

Do review the information. If a letter is about a changed or corrected tax return, the taxpayer should review the information and compare it with the original return. If the taxpayer agrees, they should make notes about the corrections on their personal copy of the tax return and keep it for their records.

Do respond to a disputed notice. If a taxpayer doesn't agree with the IRS, they should mail a letter explaining why they dispute the notice. They should mail it to the address on the contact stub included with the notice. The taxpayer should include information and documents for the IRS to review when considering the dispute.

Do remember there is usually no need to call the IRS. If a taxpayer must contact the IRS by phone, they should use the number in the upper right-hand corner of the notice. The taxpayer should have a copy of their tax return and letter when calling the agency.

Do avoid scams. The IRS will never contact a taxpayer using social media or text message. The first contact from the IRS usually comes in the mail. Taxpayers who are unsure if they owe money to the IRS can view their tax account information on IRS.gov.

Source :

https://www.irs.gov/newsroom/what-people-should-and-should-not-do-if-they-get-mail-from-the-irs

US TAX, U.S. TAXWhat people should and should not do if they get mail from the IRSmore -

Common questions about the advance Child Tax Credit payments

The advance Child Tax Credit allows qualifying families to receive early payments of the tax credit many people may claim on their 2021 tax return during the 2022 tax filing season. The IRS will disburse these advance payments monthly through December 2021. Here some details to help people better understand these payments.

Who is a qualifying child for the purposes of the advance Child Tax Credit payment?

For tax year 2021, a qualifying child is an individual who does not turn 18 before January 1, 2022, and meets these requirements:

The individual is the taxpayer's son, daughter, stepchild, eligible foster child, brother, sister, stepbrother, stepsister, half-brother, half-sister or a descendant such as a grandchild, niece, or nephew.

The individual does not provide more than one-half of his or her own support during 2021.

The individual lives with the taxpayer for more than one-half of tax year 2021. For exceptions to this requirement, see Publication 972, Child Tax Credit and Credit for Other Dependents PDF.

The individual is properly claimed as the taxpayer's dependent. For more information about how to do this, see Publication 501, Dependents, Standard Deduction, and Filing Information PDF.

The individual does not file a joint return with the individual's spouse for tax year 2021 or files it only to claim a refund of withheld income tax or estimated tax paid.

The individual was a U.S. citizen, U.S. national, or U.S. resident alien. For more information on this condition, see Publication 519, U.S. Tax Guide for Aliens PDF.

What should someone do if they don't want to receive advance Child Tax Credit payments?

Anyone who does not want to receive monthly advance Child Tax Credit payments because they would rather claim the full credit when they file their 2021 tax return, or because they know they will not be eligible for the credit in 2021 can unenroll through the Child Tax Credit Update Portal. People can unenroll at any time, but deadlines apply each month for the update to take effect for the next payment.

For people married and filing jointly, they and their spouse must unenroll using the Child Tax Credit Update Portal. If only one person unenrolls, they will still receive half the normal payment. Similarly, if you are changing bank account information, both of you must make the update so both halves of your payment go to the new account.

Will receiving advance Child Tax Credit payments affect other government benefits?

No. Advance child tax credit payments cannot be counted as income when determining if someone is eligible for benefits or assistance, or how much they can receive, under any federal, state or local program financed in whole or in part with federal funds. These programs cannot count advance child tax credit payments as a resource when determining eligibility for at least 12 months after payments are received.

Are advance Child Tax Credit payments taxable?

No. These payments are not income and will not be reported as income on a taxpayer's 2021 tax return. These payments are advance payments of a person's tax year 2021 child tax credit.

However, the total amount of advance Child Tax Credit payments someone receives is based on the IRS's estimate of their 2021 Child Tax Credit. Generally, the IRS uses information from previous tax returns to calculate a person's estimate. If the total is greater than the child tax credit amount, they can claim on their 2021 tax return, they may have to repay the excess amount on their 2021 tax return. For example, if someone receives advance Child Tax Credit payments for two qualifying children claimed on their 2020 tax return, but they no longer have qualifying children in 2021, the advance payments they received are added to their 2021 income tax unless they qualify for repayment protection.

Source :

https://www.irs.gov/newsroom/common-questions-about-the-advance-child-tax-credit-payments

US TAX, U.S. TAXCommon questions about the advance Child Tax Credit paymentsmore -

Treasury, IRS provide additional guidance to employers claiming the employee retention credit, including for the third and fourth quarters of 2021

The Treasury Department and the Internal Revenue Service today issued further guidance on the employee retention credit, including guidance for employers who pay qualified wages after June 30, 2021, and before January 1, 2022, and additional guidance on miscellaneous issues that apply to the employee retention credit in both 2020 and 2021. Notice 2021-49 PDF amplifies prior guidance regarding the employee retention credit provided in Notice 2021-20 PDF and Notice 2021-23 PDF.

Notice 2021-49 addresses changes made by the American Rescue Plan Act of 2021 (ARP) to the employee retention credit that are applicable to the third and fourth quarters of 2021.

Those changes include, among other things:

making the credit available to eligible employers that pay qualified wages after June 30, 2021, and before January 1, 2022,

expanding the definition of eligible employer to include "recovery startup businesses,"

modifying the definition of qualified wages for "severely financially distressed employers," and

providing that the employee retention credit does not apply to qualified wages taken into account as payroll costs in connection with a shuttered venue grant under section 324 of the Economic Aid to Hard-Hit Small Businesses, Non-Profits, and Venues Act, or a restaurant revitalization grant under section 5003 of the ARP.

Notice 2021-49 also provides guidance on several miscellaneous issues with respect to the employee retention credit for both 2020 and 2021. This guidance responds to various questions that the Treasury Department and the IRS have been asked about the employee retention credit, including:

The definition of full-time employee and whether that definition includes full-time equivalents,

The treatment of tips as qualified wages and the interaction with the section 45B credit,

The timing of the qualified wages deduction disallowance and whether taxpayers that already filed an income tax return must amend that return after claiming the credit on an adjusted employment tax return, and

Whether wages paid to majority owners and their spouses may be treated as qualified wages.

Reporting

Eligible employers will report their total qualified wages and the related health insurance costs for each quarter on their employment tax returns (generally, Form 941) for the applicable period. If a reduction in the employer's employment tax deposits is not sufficient to cover the credit, certain employers may receive an advance payment from the IRS by submitting Form 7200, Advance Payment of Employer Credits Due to COVID-19.

Where can I find more information on the employee retention credit and other COVID-19 economic relief efforts?

Treasury and the IRS continue to closely monitor pending legislation related to the employee retention credit and will provide additional information as needed.

Updates on the implementation of this employee retention credit, Frequently Asked Questions on Tax Credits for Required Paid Leave and other information can be found on the Coronavirus page of IRS.gov.

Source :

https://www.irs.gov/newsroom/treasury-irs-provide-additional-guidance-to-employers-claiming-the-employee-retention-credit-including-for-the-third-and-fourth-quarters-of-2021

US TAX, U.S. TAX

Treasury, IRS provide additional guidance to employers claiming the employee retention credit, including for the third and fourth quarters of 2021more -

IRS cautions taxpayers about fake charities and scammers targeting immigrants

The IRS continues to observe criminals using a variety of scams that target honest taxpayers. In some cases, these scams will trick taxpayers into doing something illegal or that ultimately causes them financial harm. These scammers may cause otherwise honest people to do things they don't realize are illegal or prey on their good will to steal their money.

Here are a couple of this year's Dirty Dozen scams.

Fake charities

Taxpayers should be on the lookout for scammers who set up fake organizations to take advantage of the public's generosity. Scammers take advantage of tragedies and disasters.

Scams requesting donations for disaster relief efforts are especially common over the phone. Taxpayers should always check out a charity before they donate, and they should not feel pressured to give immediately.

Taxpayers who give money or goods to a charity may be able to claim a deduction on their federal tax return by reducing the amount of their taxable income. However, to receive a deduction, taxpayers must donate to a qualified charity. To check the status of a charity, they can use the IRS Tax Exempt Organization Search tool. It's also important for taxpayers to remember that they can't deduct gifts to individuals or to political organizations and candidates.

Here are some tips to help taxpayer avoid fake charity scams:

Individuals should never let any caller pressure them. A legitimate charity will be happy to get a donation at any time, so there's no rush. Donors are encouraged to take time to do their own research.

Confirm the charity is real. Potential donors should ask the fundraiser for the charity's exact name, website and mailing address, so they can confirm it later. Some dishonest telemarketers use names that sound like well-known charities to confuse people.

Be careful about how a donation is made. Taxpayers shouldn't work with charities that ask for donations by giving numbers from a gift card or by wiring money. That's a scam. It's safest to pay by credit card or check — and only after researching the charity.

For more information about fake charities see the Federal Trade Commission website.

Immigrant fraud

IRS impersonators and other scammers often use threats and intimidation to target groups with limited English proficiency.

The IRS phone impersonation scam remains a common scam. This is where a taxpayer receives a phone call threatening jail time, deportation or revocation of a driver's license from someone claiming to be with the IRS. Recent immigrants often are the most vulnerable. People need to ignore these threats and not engage the scammers.

A taxpayer's first contact with the IRS will usually be through mail, not over the phone. Legitimate IRS employees will not threaten to revoke licenses or have a person deported. These are scare tactics.

New multilingual resources available

The IRS has added new features to help those who are more comfortable in a language other than English. The Schedule LEP PDF allows a taxpayer to select in which language they wish to communicate. Once they complete and submit the schedule, they will receive future communications in that selected language preference.

The IRS is providing tax information, forms and publications in many languages other than English. IRS Publication 17, Your Federal Income Tax, is now available in Spanish, Chinese simplified and traditional, Vietnamese, Korean and Russian.

Source :

https://www.irs.gov/newsroom/irs-cautions-taxpayers-about-fake-charities-and-scammers-targeting-immigrants

US TAX, U.S. TAXIRS cautions taxpayers about fake charities and scammers targeting immigrantsmore -

More than 2.2 million additional Economic Impact Payments disbursed under the American Rescue Plan

The Internal Revenue Service, U.S. Department of the Treasury, and the Bureau of the Fiscal Service announced today they have disbursed more than 2.2 million additional Economic Impact Payments under the American Rescue Plan.

Today's announcement covering the most recent six weeks of the effort brings the total disbursed so far under the American Rescue Plan to more than 171 million payments. They represent a total value of more than $400 billion since these payments began rolling out to Americans in batches on March 12.

Here is additional information on the last six weeks of payments, which includes those with official payment dates through July 21:

In total, this includes about 2.2 million payments with a value of more than $4 billion.

About 1.3 million payments, with a value of approximately $2.6 billion, went to eligible individuals for whom the IRS previously did not have information to issue an Economic Impact Payment but who recently filed a tax return.

This also includes additional ongoing supplemental payments for people who earlier this year received payments based on their 2019 tax returns but are eligible for a new or larger payment based on their recently processed 2020 tax returns. In the last six weeks, there were more than 900,000 of these "plus-up" payments, with a value of more than $1.6 billion. In all, the IRS has made more than 9 million of these supplemental payments this year worth approximately $18.5 billion.

The IRS will continue to disburse Economic Impact Payments on a weekly basis. Ongoing payments will be sent to eligible individuals for whom the IRS previously did not have information to issue a payment but who recently filed a tax return, as well to people who qualify for "plus-up" payments.

Special reminder for those who don't normally file a tax return

Although payments are automatic for most people, the IRS continues to urge people who don't normally file a tax return and haven't received Economic Impact Payments to file a 2020 tax return to get all the benefits they're entitled to under the law, including tax credits such as the 2020 Recovery Rebate Credit, the Child Tax Credit, and the Earned Income Tax Credit. Filing a 2020 tax return will also assist the IRS in determining whether someone is eligible for monthly advance payments of the 2021 Child Tax Credit, which began earlier this month.

For example, some federal benefits recipients may need to file a 2020 tax return – even if they don't usually file – to provide information the IRS needs to send payments for a qualifying dependent. Eligible individuals in this group should file a 2020 tax return as quickly as possible to be considered for an additional payment for their qualifying dependents.

People who don't normally have an obligation to file a tax return and don't receive federal benefits may qualify for these Economic Impact Payments. This includes those experiencing homelessness, the rural poor, and other historically under-served groups. Individuals who didn't get a first or second round Economic Impact Payment or got less than the full amounts may be eligible for the 2020 Recovery Rebate Credit, but they'll need to file a 2020 tax return. See the special section on IRS.gov: Claiming the 2020 Recovery Rebate Credit if you aren't required to file a tax return.

The IRS has provided an online Non-Filer tool to allow individuals who weren't required to file (and have not filed) a tax return for 2020 to file a simplified tax return. This simplified tax return allows eligible individuals to register for advance Child Tax Credit payments and the third Economic Impact Payment, as well as claim the 2020 Recovery Rebate Credit. Free tax return preparation is also available for qualifying people.

The IRS reminds taxpayers that the income levels in this third round of Economic Impact Payments have changed. This means that some people won't be eligible for the third payment even if they received a first or second Economic Impact Payment or claimed a 2020 Recovery Rebate Credit. Payments will begin to be reduced for individuals making $75,000 or above in Adjusted Gross Income ($150,000 for married filing jointly). The payments end at $80,000 for individuals ($160,000 for married filing jointly); people with Adjusted Gross Incomes above these levels are ineligible for a payment.

Individuals can check the Get My Payment tool on IRS.gov to see the payment status of these payments. Additional information on Economic Impact Payments is available on IRS.gov.

Source :

https://www.irs.gov/newsroom/more-than-2-point-2-million-additional-economic-impact-payments-disbursed-under-the-american-rescue-plan

US TAX, U.S. TAXMore than 2.2 million additional Economic Impact Payments disbursed under the American Rescue Planmore -

IRS: Monthly Child Tax Credit payments begin

The Internal Revenue Service and the Treasury Department announced today that millions of American families have started receiving monthly Child Tax Credit payments as direct deposits begin posting in bank accounts and checks arrive in mailboxes.

This first batch of advance monthly payments worth roughly $15 billion reached about 35 million families today across the country. About 86% were sent by direct deposit.

The payments will continue each month. The IRS urged people who normally aren't required to file a tax return to explore the tools available on IRS.gov. These tools can help determine eligibility for the advance Child Tax Credit or help people file a simplified tax return to sign up for these payments as well as Economic Impact Payments, and other credits you may be eligible to receive.

Under the American Rescue Plan, each payment is up to $300 per month for each child under age 6 and up to $250 per month for each child ages 6 through 17. Normally, anyone who receives a payment this month will also receive a payment each month for the rest of 2021 unless they unenroll. Besides the July 15 payment, payment dates are: Aug. 13, Sept. 15, Oct. 15, Nov. 15 and Dec. 15.

Here are further details on these payments:

Families will see the direct deposit payments in their accounts starting today, July 15. For those receiving payment by paper check, they should remember to take into consideration the time it takes to receive it by mail.

Payments went to eligible families who filed 2019 or 2020 income tax returns.

Tax returns processed by June 28 are reflected in these payments. This includes people who don't typically file a return, but during 2020 successfully registered for Economic Impact Payments using the IRS Non-Filers tool or in 2021 successfully used the Non-filer Sign-up Tool for Advance CTC, also on IRS.gov.

Payments are automatic. Aside from filing a tax return, including a simplified return from the Non-Filer Sign-Up tool, families don't have to do anything if they are eligible to receive monthly payments.

Additional information is available on a special Advance Child Tax Credit 2021 page, designed to provide the most up-to-date information about the credit and the advance payments.

Source :

https://www.irs.gov/newsroom/irs-monthly-child-tax-credit-payments-begin

US TAX, U.S. TAXIRS: Monthly Child Tax Credit payments beginmore -

IRS: Online Child Tax Credit eligibility tool now available in Spanish; other multilingual materials help families see if they qualify for advance payments

The Internal Revenue Service has launched a new Spanish-language version of its online tool, Child Tax Credit Eligibility Assistant, designed to help families determine whether they qualify for the Child Tax Credit and the special monthly advance payments of the credit, due to begin on July 15.

Available exclusively on IRS.gov, the new Spanish version of the tool, like its English-language counterpart, is interactive and easy to use. By answering a series of questions about themselves and their family members, a parent or other family member can quickly determine whether they qualify for the credit.

Though anyone can use this tool, it may be particularly useful to families who don't normally file a federal tax return and have not yet filed either a 2019 or 2020 return. Often, these are people who receive little or no income, including those experiencing homelessness, low income households, and other underserved groups. Using this tool can help them decide whether they should take the next step and either register for the Child Tax Credit payments using another IRS tool, the Non-filer Sign-up Tool, or file a regular tax return using the IRS Free File system.

To help people understand and receive this benefit, the IRS has developed materials in several languages and additional multi-lingual resources will roll out in coming weeks and months. All tools and materials, in English and other languages, are posted on a special Advance Child Tax Credit 2021 page at IRS.gov/childtaxcredit2021.

Multilingual resources already available include:

A step-by-step guide to using the Non-filer Sign-up Tool (Publication 5538) in Spanish, Chinese Simplified, Korean, Vietnamese, Haitian Creole and Russian.

A basic You Tube video on the Advance Child Tax Credit in Spanish and Chinese, as well as English.

E-posters in various languages.

Information about Free File in seven languages.

Besides the Child Tax Credit, the IRS has a variety of tax-related tools and resources available in various languages.

Community partners can help

The IRS urges community groups, especially those who serve non-English speakers, to help share this critical information about the Advance Child Tax Credit as well as other important benefits. This includes nonprofits, associations, education organizations and anyone else with connections to people with children. Among other things, The IRS is providing these groups with information that can be easily shared through social media, email and other methods.

Watch out for scams

The IRS urges everyone, especially those who speak languages other than English, to be on the lookout for scams related to both Advance Child Tax Credit payments and Economic Impact Payments. In particular, scammers often target non-English speakers and underserved communities. The IRS emphasized that the only way to get either of these benefits is by either filing a tax return with the IRS or registering online through the Non-filer Sign-up Tool, exclusively on IRS.gov. Any other option is a scam.

Watch out for scams using email, phone calls or texts related to the payments. Remember, the IRS never sends unsolicited electronic communications asking anyone to open attachments or visit a non-governmental web site.

More about the Child Tax Credit Eligibility Assistant

The Child Tax Credit Eligibility Assistant does not request any personally-identifiable information (PII) for any family member. For that reason, its results are not an official determination by the IRS. Though the results are reliable, if the questions are answered accurately, they should be considered preliminary. Neither the answers supplied by the user, nor the results, are retained by the IRS.

Non-filer Sign-Up Tool

If the Child Tax Credit Eligibility Assistant indicates that a family qualifies for the credit, the next step is to either register with the IRS or file a return. For families who don't normally need to file a return, The online Non-filer Sign-Up Tool is the easiest way to register for the advance payments.

This tool, an update of last year's IRS Economic Impact Payment Non-filers tool, is also designed to help eligible individuals who don't normally file tax returns register for the $1,400 third round of Economic Impact Payments (also known as stimulus checks). In addition, it can help them claim the Recovery Rebate Credit for any amount of the first two rounds of Economic Impact Payments they may have missed.

Developed in partnership with Intuit and delivered through the Free File Alliance, the tool enables them to provide the IRS with basic information, such as their name, address, and social security numbers, as well as information about their qualifying children age 17 and under and their other dependents. It also enables them to provide their bank account information, so the IRS can quickly and easily deposit the payments directly into their checking or savings account.

The Non-filer Sign-Up tool should not be used by anyone who has already filed a 2019 or 2020 federal income tax return, or plans to do so.

Free File; a better option for some

Though the Non-filer Sign-up Tool is the easiest way to register for Advance Child Tax Credit payments, it may not be the best option for all families. That's because many families also qualify for the Earned Income Tax Credit and other benefits for low-and moderate-income people. For them, a better option is filing a regular tax return using the Free File system, available only on IRS.gov.

About the Advance Child Tax Credit

The expanded and newly-advanceable Child Tax Credit was authorized by the American Rescue Plan Act, enacted in March. Normally, the IRS will calculate the payment based on a family's 2020 tax return, including those who use the Non-filer Sign-up Tool. If that return is not available because it has not yet been filed or is still being processed, the IRS will instead determine the initial payment amounts using the 2019 return or the information entered using the Non-filers tool that was available in 2020.

The payment will be up to $300 per month for each child under age 6 and up to $250 per month for each child age 6 through 17.

To make sure families have easy access to their money, the IRS will issue these payments by direct deposit, as long as correct banking information has previously been provided to the IRS. Otherwise, people should watch their mail around July 15 for their mailed payment. The dates for the Advance Child Tax Credit payments are July 15, Aug. 13, Sept. 15, Oct. 15, Nov. 15, and Dec. 15.

Source :

https://www.irs.gov/newsroom/irs-online-child-tax-credit-eligibility-tool-now-available-in-spanish-other-multi-lingual-materials-help-families-see-if-they-qualify-for-advance-payments

US TAX, U.S. TAXIRS: Online Child Tax Credit eligibility tool now available in Spanish; other multilingual materials help families see if they qualify for advance paymentsmore -

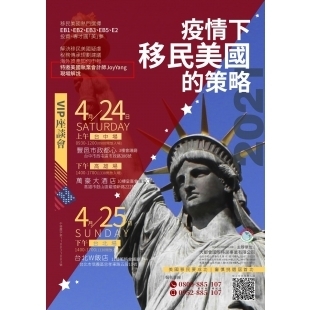

Apr. 24-25 Metropolitan Immigration Consulting Group Seminar

Apr. 24-25 Metropolitan Immigration Consulting Group SeminarApr. 24-25 Metropolitan Immigration Consulting Group Seminarmore