All News

-

Some things taxpayers getting ready to file should know

IRS Tax Tip 2023-33, March 14, 2023

With the 2023 tax filing season in full swing, taxpayers should be sure to visit IRS.gov for updated resources and tools to help with their 2022 tax return.

Things to know before filing

Taxpayers should wait to file until they receive all their proper tax documents, or they risk making a mistake that could cause delays.

They should also review their income documents carefully. If any of the information is inaccurate or missing, taxpayers should contact the payer right away for a correction or to ensure the issuer has their current mailing or email address.

Creating an IRS Online Account can help taxpayers securely access information about their federal tax account, including payments, tax records and more.

Organized tax records make preparing a complete and accurate tax return easier and may help taxpayers find overlooked deductions or credits.

Taxpayers with an Individual Taxpayer Identification Number or ITIN may need to renew it if it's expired and is needed on a U.S. federal tax return. If they don't renew an expiring or expired ITIN, the IRS can still accept their return, but it may delay processing or credits owed.

Taxpayers should visit IRS.gov for information and answers to common tax questions

The IRS Interactive Tax Assistant helps taxpayers find answers tax questions based on their specific circumstances. Taxpayers can use it to determine if they must file a tax return, their filing status, if they can claim a dependent, if the type of income they have is taxable, if they're eligible to claim a credit or if they can deduct expenses.

IRS Tax Topics contain general individual and business tax information. If taxpayers don't find the answers to their question, they can check Frequently Asked Questions.

The Let Us Help You page lists many other online resources.

Taxpayers can find IRS forms, instructions and publications they need to file tax return at Forms, Instructions & Publications.

Once a taxpayer has filed their return, they can track the status of their return with the Where's My Refund? tool at IRS.gov/wheresmyrefund.

Subscribe to IRS Tax Tips

US TAX, U.S. TAX

Resource:https://www.irs.gov/newsroom/some-things-taxpayers-getting-ready-to-file-should-knowSome things taxpayers getting ready to file should knowmore -

Tax Time Guide: Using electronic payment and agreement options for taxpayers who owe can help avoid penalties and interest

IR-2023-44, March 9, 2023

WASHINGTON ― With the tax deadline approaching, the IRS reminded taxpayers they can avoid late filing and interest penalties by submitting their tax return and any payments due by April 18. For struggling taxpayers who can't pay by the deadline, the IRS offers several different options to help.

The IRS also provides multiple ways for people to file for an extension, get information to help file their tax return and learn about payment options if they have trouble paying by the April 18 deadline.

Eligible individuals and families who earned $73,000 or less in 2022 can use IRS Free File, available only on IRS.gov, to electronically file their taxes. All taxpayers, regardless of income, who need more time to file a return can use IRS Free File as an easy and quick way to electronically file for a six-month extension before April 18, 2023. An extension will help to avoid penalties and interest for failing to file on time, and gives taxpayers until Oct. 16, 2023, to file. However, they still must pay what they owe by the April 18 deadline.

Except for eligible victims of recent natural disasters who have until Oct. 16 to make various tax payments, taxpayers who can't pay the full amount of taxes they owe by April 18 should file and pay what they can to reduce total penalties and interest.

There are several ways to make electronic payments, and there are options for a payment plan or agreement.

IRS Online Account

An IRS Online Account provides access to important information when preparing to file a tax return, pay a balance or follow up on notices. Taxpayers can view their:

Adjusted Gross Income.

Payment history and any scheduled or pending payments.

Payment plan details.

Digital copies of select notices from the IRS.

Taxpayers can also use their Online Account to securely make a same-day payment for an outstanding 2022 tax balance, pay quarterly estimated taxes for the 2023 tax season or request an extension to file a 2022 return.

Interest and a late payment penalty will apply to any payments made after April 18. Making a payment, even a partial payment, will help limit penalty and interest charges.

Other options to pay electronically

Direct Pay, available only on IRS.gov, is the fastest and easiest way to make a one-time payment without signing into an IRS Online Account.

Direct Pay: Direct Pay is free and allows taxpayers to securely pay their federal taxes directly from their checking or savings account without any fees or preregistration. Taxpayers can schedule payments up to 365 days in advance. After submitting a payment through Direct Pay, taxpayers will receive immediate confirmation.

Electronic Funds Withdrawal (EFW): This option allows taxpayers to file and pay electronically from their bank account when using tax preparation software or a tax professional. This option is free and only available when electronically filing a tax return.

Electronic Federal Tax Payment System: This free service gives taxpayers a safe and convenient way to pay individual and business taxes by phone or online. To enroll and for more information, taxpayers can call 800-555-4477 or visit eftps.gov.

Debit or credit card or digital wallet: Individuals can pay online, by phone or with a mobile device through any of the authorized payment processors. The processor charges a fee. The IRS doesn't receive any fees for these payments. Authorized card processors and phone numbers are available at IRS.gov/payments.

Other payment options:

Cash: For taxpayers who prefer to pay in cash, the IRS offers a way to pay taxes at one of its Cash Processing Company services. The IRS urges taxpayers choosing this option to start early because it involves a four-step process. Details, including answers to frequently asked questions, are at IRS.gov/paywithcash.

Check or money order: Payments made by check or money order should be made payable to the "United States Treasury." To help ensure that the payment gets credited promptly, taxpayers should also enclose a 2022 Form 1040-VPDF payment voucher and print the following on the front of the check or money order:

"2022 Form 1040"

Name

Address

Daytime phone number

Social Security number

For taxpayers who cannot pay in full

The IRS encourages taxpayers who cannot pay in full to pay what they can and consider a variety of payment options available for the remaining balance including getting a loan to pay the amount due. In many cases, loan costs may be lower than the combination of interest and penalties the IRS must charge under federal law. Taxpayers should act as quickly as possible: Tax bills accumulate more interest and fees the longer they remain unpaid. For all payment options, visit IRS.gov/payments.

Online self-service payment plans

Most individual taxpayers qualify for a payment plan and can use Online Payment Agreement to set up a payment plan (including an installment agreement) to pay off an outstanding balance over time.

Once the online application is completed, the taxpayer receives immediate notification of whether their payment plan has been approved. Taxpayers can setup a plan using the Online Payment Agreement in a matter of minutes. There's no paperwork and no need to call, write or visit the IRS. Setup fees may apply for some types of plans.

Online payment plan options for individual taxpayers include:

Short-term payment plan – The total balance owed is less than $100,000 in combined tax, penalties and interest. Additional time of up to 180 days to pay the balance in full.

Long-term payment plan (installment agreement) – The total balance owed is less than $50,000 in combined tax, penalties and interest. Pay in monthly payments for up to 72 months. Payments may be set up using direct debit (automatic bank withdraw) which eliminates the need to send in a payment each month, saving postage costs, and reducing the chance of default. For balances between $25,000 and $50,000, direct debit is required.

Qualified taxpayers with existing payment plans may be able to use the Online Payment Agreement to make changes including revising payment dates, payment amounts or bank information for payments made by direct debit. Go to Online Payment Agreement for more information.

Though interest and late-payment penalties continue to accrue on any unpaid taxes after April 18, the failure to pay the tax penalty rate is cut in half while an installment agreement is in effect. Find more information about the costs of payment plans on the IRS' Additional Information on Payment Plans webpage.

Other payment options

Taxpayers struggling to meet their tax obligation may also consider these additional payment options:

Offer in Compromise – Certain taxpayers qualify to settle their tax liabilities for less than the total amount they owe by submitting an Offer in Compromise. To help determine their eligibility, they can use the Offer in Compromise Pre-Qualifier tool. To help taxpayers prepare their own valid Offers in Compromise, the IRS created an Offer in Compromise video playlist – also available in Spanish and Simplified Chinese – that walks them through the necessary paperwork.

Temporary delay of collection – Taxpayers can contact the IRS to request a temporary delay of the collection process. If the IRS determines a taxpayer is unable to pay, it may delay collection until the taxpayer's financial condition improves. Penalties and interest continue to accrue until the full amount is paid.

Other payment plan options – Taxpayers who do not qualify for online self-service should contact the IRS using the phone number or address on their most recent notice for other payment plan options. For individuals and out-of-business sole proprietors who are already working with IRS Campus Collection and who owe $250,000 or less, one available option is to propose a monthly payment that will pay the balance over the length of the Collection Statute (usually 10 years). These payment plans don't require a financial statement, but they do require a determination for the filing of a Notice of Federal Tax Lien still applies.

For more information about payments, see Topic No. 202, Tax Payment Options, on IRS.gov.

Taxpayer Rights

The IRS reminds taxpayers that they have rights and protections throughout the collection process. For details, see Taxpayer Bill of Rights and Publication 1, Your Rights as a TaxpayerPDF.

Taxpayers should know before they owe. The IRS encourages all taxpayers to check their withholding with the IRS Tax Withholding Estimator.

This news release is part of a series called the Tax Time Guide, a resource to help taxpayers file an accurate tax return. Additional help is available in Publication 17, Your Federal Income Tax.

US TAX, U.S. TAX

Resource:https://www.irs.gov/newsroom/tax-time-guide-using-electronic-payment-and-agreement-options-for-taxpayers-who-owe-can-help-avoid-penalties-and-interestTax Time Guide: Using electronic payment and agreement options for taxpayers who owe can help avoid penalties and interestmore -

Taxpayers should know that an extension to file is not an extension to pay taxes

IRS Tax Tip 2023-30, March 8, 2023

Taxpayers who aren't able to file by the April 18, 2023, deadline can request an extension before that deadline, but they should know that an extension to file is not an extension to pay taxes. If they owe taxes, they should pay them before the due date to avoid potential penalties and interest on the amount owed.

Taxpayers who request a six-month extension to file their taxes have until October 16, 2023, to file their 2022 federal income tax return.

How to request a free extension to file for a return with no tax due

Individual taxpayers, regardless of income, can use IRS Free File at IRS.gov/freefile to request an automatic six-month tax-filing extension. Alternatively, taxpayers can file Form 4868, Application for Automatic Extension of Time to File.

How to request an extension when making a payment for a return with taxes due

Taxpayers can choose to submit an electronic payment and select Form 4868 or extension as the payment type. The IRS will count it as an extension automatically, and taxpayers won't need to file Form 4868

Victims in FEMA disaster areas may have an automatic extension

The IRS may offer an automatic extension to areas designated by the Federal Emergency Management Agency. To check whether an area is included, see Tax Relief in Disaster Situations. Taxpayers in the affected areas do not need to file any extension paperwork, and they do not need to call the IRS to qualify for the extended time.

U.S. citizens and resident aliens abroad and military members in combat zones may have more time to pay

Taxpayers living overseas, including members of the military and eligible support personnel serving in combat zones may also have extra time to file their tax returns and pay any taxes due.

More information:

What Is the Due Date of My Federal Tax Return or Am I Eligible to Request an Extension?

Source: https://www.irs.gov/newsroom/taxpayers-should-know-that-an-extension-to-file-is-not-an-extension-to-pay-taxes

US TAX, U.S. TAXTaxpayers should know that an extension to file is not an extension to pay taxesmore -

The IRS offers easy and convenient options to make federal tax payments

IRS Tax Tip 2023-28, March 6, 2023

Anyone who needs to pay their federal tax bill has several ways to send a payment to IRS quickly and securely. Knowing the options to make payments helps taxpayers meet their tax obligations.

Here are several ways people who owe taxes can pay it. They can:

Pay when they e-file using electronic funds withdrawal to draw the payment directly from their bank account.

Sign into their Online Account to pay their 2022 balance or make estimated tax payments. Taxpayers can also see their payment history, any scheduled or pending payments, and other account details.

Use IRS Direct Pay to pay electronically directly from their checking or savings account. They can choose to receive email notifications about their payments when they pay this way

Pay using a payment processor by credit card, debit card or digital wallet. Taxpayers can make these payments online for a fee.

Make a cash payment at more than 60,000 participating retail locations nationwide. To pay with cash, taxpayers should visit IRS.gov and follow the instructions.

Pay over time by applying for an online payment agreement. Once the IRS accepts an agreement, taxpayers can make their payment in monthly installments.

For details on these options, people can visit IRS.gov/payments.

Estimated taxes

Some taxpayers must make quarterly estimated tax payments throughout the year. This includes individuals, sole proprietors, partners, and S corporation shareholders who expect to owe $1,000 or more when they file. Individuals who participate in the gig economy might also have to make estimated payments.

Source: https://www.irs.gov/newsroom/the-irs-offers-easy-and-convenient-options-to-make-federal-tax-payments

US TAX, U.S. TAXThe IRS offers easy and convenient options to make federal tax paymentsmore -

Tax Time Guide: IRS reminder to report all income; gig economy and service industry, digital or foreign assets and sources

IR-2023-35, March 1, 2023

WASHINGTON — The Internal Revenue Service reminds taxpayers of their reporting and potential tax obligations on income from the gig economy and service industry, transactions from digital assets, and foreign sources or holding certain foreign assets.

Information available on IRS.gov and Instructions for Form 1040 and Form 1040-SR can help taxpayers understand and meet these reporting and tax requirements.

Gig economy earnings are taxable

Generally, income earned from the gig economy is taxable and must be reported to the IRS on tax returns.

The gig economy is activity where people earn income providing on-demand work, services or goods, such as selling goods online, driving a car for deliveries or renting out property. Often, it's through a digital platform like an app or website.

Taxpayers must report income earned from the gig economy on a tax return, even if the income is:

From part-time, temporary or side work.

Paid in any form, including cash, property, goods or digital assets

Not reported on an information return form like a Form 1099-K, 1099-MISC, W-2 or other income statement.

For more information on the gig economy, visit the gig economy tax center.

Service industry tips are also taxable

People who work in restaurants, salons, hotels and similar service industries often receive tips for the customer service they provide. Tips are usually taxable income, and it's important for people working in these areas to understand details on how to report tips.

Tips are optional cash or noncash payments customers make to employees.

Cash tips include those received directly from customers, electronically paid tips distributed to the employee by their employer and tips received from other employees under any tip-sharing arrangement. All cash tips must be reported to the employer, who must include them on the employee's Form W-2, Wage and Tax Statement.

Noncash tips are those of value received in any other medium than cash, such as: tickets, passes or other goods or commodities a customer gives the employee. Noncash tips aren't reported to the employer but must be reported on a tax return.

Any tips the employee didn't report to the employer must be reported separately on Form 4137, Social Security and Medicare Tax on Unreported Tip Income, to include as additional wages with their tax return. The employee must also pay the employee share of Social Security and Medicare tax owed on those tips.

Employees don't have to report tip amounts of less than $20 per month per employer. For larger amounts, employees must report tips to the employer by the 10th of the month following the month the tips were received.

The employee can use Form 4070, Employee's Report of Tips to Employer, available in Publication 1244, Employee's Daily Record of Tips and Report to Employer, an employer-provided form or other electronic system used by their employer.

For more information on how to report tips see Tip Recordkeeping and Reporting.

Understand digital asset reporting and tax requirements

The IRS reminds taxpayers that there's a question at the top of Forms 1040 and 1040-SR that asks about digital asset transactions. All taxpayers filing these forms must check the box indicating either "yes" or "no."

If an individual disposed of any digital asset that was held as a capital asset through a sale, exchange or transfer, they should check "Yes" and use Form 8949, Sales and other Dispositions of Capital Assets, to figure their capital gain or loss and report it on Schedule D (Form 1040), Capital Gains and Losses, or Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return, in the case of a gift.

Examples of transactions involving digital assets include:

A sale of digital assets.

The receipt of digital assets as payment for goods or services provided.

The receipt or transfer of digital assets for free (without providing any consideration) that does not qualify as a bona fide gift.

The receipt of new digital assets as a result of mining and staking activities.

The receipt of new digital assets as a result of a hard fork.

An exchange of digital assets for property, goods or services.

An exchange/trade of digital assets for another digital asset(s).

Any other disposition of a financial interest in digital assets.

If individuals received any digital assets as compensation for services or disposed of any digital assets they held for sale to customers in a trade or business, they must report the income as they would report other income of the same type (for example, W-2 wages on Form 1040 or 1040-SR, line 1a, or inventory or services on Schedule C).

More information on digital assets can be found in the Instructions for Form 1040 and 1040-SR and on the IRS' Digital Assets page.

Report foreign source income

A U.S. citizen or resident alien's worldwide income is generally subject to U.S. income tax, regardless of where they live. They're also subject to the same income tax filing requirements that apply to U.S. citizens or resident aliens living in the United States.

U.S. citizens and resident aliens must report unearned income, such as interest, dividends and pensions from sources outside the United States unless exempt by law or a tax treaty. They must also report earned income, such as wages and tips, from sources outside the United States.

An income tax filing requirement generally applies even if a taxpayer qualifies for tax benefits, such as the Foreign Earned Income Exclusion or the Foreign Tax Credit, which substantially reduce or eliminate U.S. tax liability. These tax benefits are available only if an eligible taxpayer files a U.S. income tax return.

A taxpayer is allowed an automatic two-month extension to June 15 if both their tax home and abode are outside the United States and Puerto Rico. Even if allowed an extension, a taxpayer will have to pay interest on any tax not paid by the regular due date of April 18, 2023.

Those serving in the military outside the U.S. and Puerto Rico on the regular due date of their tax return also qualify for the extension to June 15. IRS recommends attaching a statement if one of these two situations applies. More information can be found in the Instructions for Form 1040 and Form 1040-SR, Publication 54, Tax Guide for U.S. Citizens and Resident Aliens Abroad and Publication 519, U.S. Tax Guide for Aliens.

Reporting required for foreign accounts and assets

Federal law requires U.S. citizens and resident aliens to report their worldwide income, including income from foreign trusts and foreign bank and other financial accounts. In most cases, affected taxpayers need to complete and attach Schedule B (Form 1040), Interest and Ordinary Dividends, to their tax return. Part III of Schedule B asks about the existence of foreign accounts such as bank and securities accounts and usually requires U.S. citizens to report the country in which each account is located.

In addition, certain taxpayers may also have to complete and attach to their return Form 8938, Statement of Foreign Financial Assets. Generally, U.S. citizens, resident aliens and certain nonresident aliens must report specified foreign financial assets on this form if the aggregate value of those assets exceeds certain thresholds. See the instructions for this form for details.

Further, separate from reporting specified foreign financial assets on their tax return, U.S. persons with an interest in or signature or other authority over foreign financial accounts where the aggregate value exceeded $10,000 at any time during 2022 must file electronically with the Treasury Department a Financial Crimes Enforcement Network (FinCEN) Form 114, Report of Foreign Bank and Financial Accounts (FBAR). Because of this threshold, the IRS encourages U.S. persons with foreign assets, even relatively small ones, to check if this filing requirement applies to them. The form is available only through the BSA E-filing System website.

The deadline for filing the annual Report of Foreign Bank and Financial Accounts (FBAR) is April 15, 2023. FinCEN grants U.S. persons who miss the original deadline an automatic extension until Oct. 15, 2023, to file the FBAR. There is no need to request this extension. See FinCEN'sPDF website for further information.

This news release is part of a series called the Tax Time Guide, a resource to help taxpayers file an accurate tax return. Additional guidance is available in Publication 17, Your Federal Income Tax (For Individuals).

Source: https://www.irs.gov/newsroom/tax-time-guide-irs-reminder-to-report-all-income-gig-economy-and-service-industry-digital-or-foreign-assets-and-sources

US TAX, U.S. TAXTax Time Guide: IRS reminder to report all income; gig economy and service industry, digital or foreign assets and sourcesmore -

What to do when a W-2 or Form 1099 is missing or incorrect

IRS Tax Tip 2023-25, February 28, 2023

It's important for taxpayers to have all their documents and information so they can file an accurate and complete tax return. This may mean waiting to file until they receive all their documentation – and it can also mean following up on missing or incorrect documents.

Most taxpayers should have received income documents near the end of January. These may include:

Form W-2, Wage and Tax Statement

Form 1099-MISC, Miscellaneous Income

Form 1099-INT, Interest Income

Form 1099-NEC, Nonemployee Compensation

Form 1099-G, Certain Government Payments; like unemployment compensation or state tax refund

Taxpayers should first contact the employer, payer or issuing agency directly for copies

Taxpayers who haven't received a W-2 or Form 1099 should contact the employer, payer or issuing agency and request a copy of the missing document or a corrected document.

If they can't get a copy, they can contact the IRS for help

Taxpayers should file their tax return on time – this year's tax deadline is April 18 for most filers – even if they still have missing or incorrect documents. If they don't receive the missing or corrected form from their employer or payer by the end of February, they may call the IRS at 800-829-1040 for help. They'll need to provide their name, address, phone number, Social Security number and dates of employment. They'll also need to provide the employer's or payer's name, address and phone number. The IRS will contact the employer or payer and request the missing form.

Estimating income when forms are incorrect or missing

After the taxpayer contacts the IRS about missing documents, the IRS will send the taxpayer one of these forms:

Form 4852, Substitute for Form W-2, Wage and Tax Statement or Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, Etc.

If the taxpayer doesn't receive the missing form in time to file their income tax return by the filing due date, they may complete Form 4852 or Form 1099-R to estimate their wages and earnings. They then attach the relevant form to their tax return when they file.

Taxpayers may need to file an amended return if they filed with missing or incorrect info

If they receive the missing or corrected Form W-2 or Form 1099-R after filing their return and the information differs from their previous estimate, they must file Form 1040-X, Amended U.S. Individual Income Tax Return.

Incorrect Form 1099-G for unemployment benefits

Taxpayers who receive an incorrect Form 1099-G for unemployment benefits they did not receive should contact the issuing state agency to request a revised Form 1099-G showing they did not receive these benefits. Taxpayers who are unable to obtain a timely, corrected form from the state should still file an accurate tax return, reporting only the income they received.

More information:

Amended Returns

Should I File an Amended Return?

W-2 – Additional, Incorrect, Lost, Non-Receipt, Omitted

Let Us Help You

Source: https://www.irs.gov/newsroom/what-to-do-when-a-w-2-or-form-1099-is-missing-or-incorrect

US TAX, U.S. TAXWhat to do when a W-2 or Form 1099 is missing or incorrectmore -

Tax Time Guide: Things to consider when filing a 2022 tax return

IR-2023-32, Feb. 22, 2023

WASHINGTON — With the 2023 tax filing season in full swing, the Internal Revenue Service reminds taxpayers to gather their necessary information and visit IRS.gov for updated resources and tools to help with their 2022 tax return.

This news release is part of a series called the Tax Time Guide, a resource to help taxpayers file an accurate tax return. Additional guidance is available in Publication 17, Your Federal Income Tax (For Individuals).

Things to consider before filing

Taxpayers should wait to file until they receive all their proper tax documents, or they risk making a mistake that could cause delays.

They should also review their documents carefully. If any of the information is inaccurate or missing, taxpayers should contact the payer right away for a correction or to ensure the issuer has their current mailing or email address.

Creating an IRS Online Account can help taxpayers securely access information about their federal tax account, including payments, tax records and more.

Organized tax records make preparing a complete and accurate tax return easier and may help taxpayers find overlooked deductions or credits.

Taxpayers with an Individual Taxpayer Identification Number or ITIN may need to renew it if it's expired and is needed on a U.S. federal tax return. If they don't renew an expiring or expired ITIN, the IRS can still accept their return, but it may delay processing or credits owed.

Changes to credits and deductions for tax year 2022

Unlike 2020 and 2021, there were no new stimulus payments for 2022, so taxpayers should not expect to get an additional payment in their 2023 tax refund.

However, taxpayers may still qualify for temporarily expanded eligibility of the Premium Tax Credit, a refundable credit that helps eligible individuals and families cover the premiums for their health insurance purchased through the Health Insurance Marketplace. To get this credit, taxpayers must meet certain requirements and file a tax return with Form 8962, Premium Tax Credit.

Also, eligibility rules changed to claim a Clean Vehicle Credit under the Inflation Reduction Act of 2022.

Some tax credits return to 2019 levels. This means that taxpayers will likely receive a significantly smaller refund compared with the previous tax year.

Changes include amounts for the Earned Income Tax Credit (EITC), the Child Tax Credit (CTC) and the Child and Dependent Care Credit will revert to pre-COVID levels.

For the EITC, eligible taxpayers with no children who received roughly $1,500 in 2021 will now get $560 for the 2022 tax year.

Those who got $3,600 per dependent in 2021 for the CTC will, if eligible, get $2,000 per dependent for the 2022 tax year.

The Child and Dependent Care Credit returns to a maximum of $2,100 in 2022 instead of $8,000 in 2021.

Finally, taxpayers that don't itemize and take the standard deduction cannot deduct their charitable contributions this year.

Transition year for 1099-K reporting

There are no changes to what counts as income or how tax is calculated, including income from the sale of personal assets. Taxpayers must report all their income on their tax return unless it's excluded by law.

Form 1099-K, Payment Card and Third-Party Network Transactions, is an IRS information return used to report certain payment transactions and helps to improve voluntary tax compliance. Taxpayers use this information return with their other tax records to determine their correct tax liability. 2022 Forms 1099-K should have been furnished to the payee by Jan. 31, 2023.

The American Rescue Plan of 2021 changed the reporting threshold for third-party settlement organizations, including payment apps and online settlement organizations. The new threshold requires reporting of transactions in excess of $600 per year; changed from the previous threshold of an excess of $20,000 and an excess of 200 transactions per year. Third-party settlement organizations are required to report payments for goods and services.

On Dec. 23, 2022, the IRS announced that calendar year 2022 will be treated as a transition year for the reduced reporting threshold of $600.

Even though the Form 1099-K reduced reporting requirement for third-party settlement organizations is delayed, some individuals may still receive a Form 1099-K who have not received one in the past. Some individuals may receive a Form 1099-K for the sale of personal items or in situations where they received a Form 1099-K in error (i.e. for transactions between friends and family, or expense sharing).

Money received as a gift or to reimburse shared meals or rent should not be reported on a 1099-K. Payments should indicate whether they are personal to family and friends or a business transaction for goods and services.

If the information is incorrect on the 1099-K, taxpayers should contact the payer immediately. The payer's name appears in the upper left corner on the form. The taxpayer should keep a copy of all correspondence with the payer with their records.

If a Form 1099-K is received in error and a corrected Form 1099-K can't be obtained, follow the IRS' updated guidance at Understanding Your Form 1099-K.

Source: https://www.irs.gov/newsroom/tax-time-guide-things-to-consider-when-filing-a-2022-tax-return

US TAX, U.S. TAXTax Time Guide: Things to consider when filing a 2022 tax returnmore -

Understanding the Credit for Other Dependents

IRS Tax Tip 2023-22, February 21, 2023

Taxpayers with dependents who don't qualify for the Child Tax Credit may be able to claim the Credit for Other Dependents. They can claim this credit in addition to the Child and Dependent Care Credit and the Earned Income Credit.

Here's more information to help taxpayers determine whether they're eligible to claim the Credit for Other Dependents on their 2022 tax return.

The maximum credit amount is $500 for each dependent who meets certain conditions. This credit can be claimed for:

Dependents of any age, including those who are age 18 or older.

Dependents who have Social Security numbers or Individual Taxpayer Identification numbers.

Dependent parents or other qualifying relatives supported by the taxpayer.

Dependents living with the taxpayer who aren't related to the taxpayer.

The credit begins to phase out when the taxpayer's income is more than $200,000. This phaseout begins for married couples filing a joint tax return at $400,000.

A taxpayer can claim this credit if:

They claim the person as a dependent on the taxpayer's return.

They cannot use the dependent to claim the child tax credit or additional child tax credit.

The dependent is a U.S. citizen, national or resident alien.

Taxpayers can use the Does My Child/Dependent Qualify for the Child Tax Credit or the Credit for Other Dependents tool on IRS.gov to help determine if they are eligible to claim the credit.

More information:

Topic No. 602 Child and Dependent Care Credit

Earned Income Tax Credit

Resource: https://www.irs.gov/newsroom/understanding-the-credit-for-other-dependents

US TAX, U.S. TAXUnderstanding the Credit for Other Dependentsmore -

Interest rates remain the same for the second quarter of 2023

IR-2023-24, Feb. 13, 2023

WASHINGTON — The Internal Revenue Service today announced that interest rates will remain the same for the calendar quarter beginning April 1, 2023.

For individuals, the rate for overpayments and underpayments will be 7% per year, compounded daily. Here is a complete list of the new rates:

7% for overpayments (payments made in excess of the amount owed), 6% for corporations.

4.5% for the portion of a corporate overpayment exceeding $10,000.

7% for underpayments (taxes owed but not fully paid).

9% for large corporate underpayments.

Under the Internal Revenue Code, the rate of interest is determined on a quarterly basis. For taxpayers other than corporations, the overpayment and underpayment rate is the federal short-term rate plus 3 percentage points.

Generally, in the case of a corporation, the underpayment rate is the federal short-term rate plus 3 percentage points, and the overpayment rate is the federal short-term rate plus 2 percentage points. The rate for large corporate underpayments is the federal short-term rate plus 5 percentage points. The rate on the portion of a corporate overpayment of tax exceeding $10,000 for a taxable period is the federal short-term rate plus one-half (0.5) of a percentage point.

The interest rates announced today are computed from the federal short-term rate determined during January 2023. See the revenue ruling for details.

Revenue Ruling 2023-4PDF announcing the rates of interest will appear in Internal Revenue Bulletin 2023-9, dated Feb. 27, 2023.

Source: https://www.irs.gov/newsroom/interest-rates-remain-the-same-for-the-second-quarter-of-2023

US TAX, U.S. TAXInterest rates remain the same for the second quarter of 2023more -

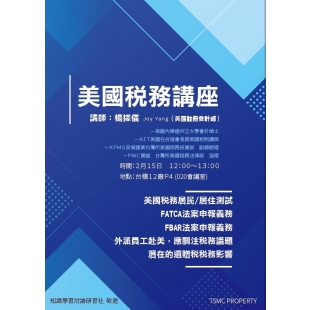

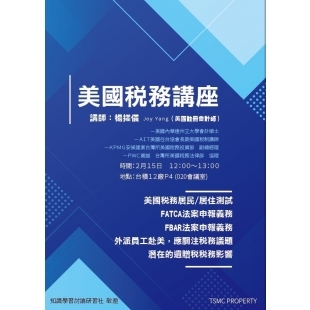

Feb.15 TSMC's US tax seminar

US tax residency/residence test

FATCA filing obligations

FBAR Act filing obligations

Expatriate employees going to the United States tax issues

Potential estate tax implicationsFeb.15 TSMC's US tax seminarmore -

Key points to keep in mind when filing 2022 tax returns

IR-2023-17, January 31, 2023

WASHINGTON — To help taxpayers navigate the beginning of the tax filing season, the Internal Revenue Service today offered a checklist of reminders for people as they prepare to file their 2022 tax returns.

From gathering paperwork to filing a tax return, these easy steps will make tax preparation smoother in 2023:

1. Gather tax paperwork and records for accuracy to avoid missing a deduction or credit.

Taxpayers should have all their important and necessary documents before preparing their return. This helps people file a complete and accurate tax return. Errors and omissions slow down tax processing, including refund times.

Some information taxpayers need before they begin includes:

Social Security numbers for everyone listed on the tax return,

Bank account and routing numbers,

Various tax forms such as W-2s, 1099s, 1098s and other income documents or records of digital asset transactions,

Form 1095-A, Health Insurance Marketplace statement,

Any IRS letters citing an amount received for a certain tax deduction or credit.

2. Remember to report all types of income on the tax return.

This is important to avoid receiving a notice or a bill from the IRS. Don't forget to include income from:

Goods created and sold on online platforms,

Investment income,

Part-time or seasonal work,

Self-employment or other business activities,

Services provided through mobile apps.

3. File electronically with direct deposit to avoid delays in receiving a refund.

Avoid paper returns. Tax software helps individuals avoid mistakes by doing the math. It guides people through each section of their tax return using a question-and-answer format.

For those waiting on their 2021 tax return to be processed, here's a special tip to ensure their 2022 tax return is accepted by the IRS for processing. Make sure to enter $0 (zero dollars) for last year's adjusted gross income (AGI) on the 2022 tax return. Everyone else should enter their prior year's AGI from last year's return.

4. Free resources are available to help eligible taxpayers file online. Free help may also be available to qualified taxpayers.

IRS Free File provides a free online alternative to filing a paper tax return. IRS Free File is available to any individual or family who earned $73,000 or less in 2022.

With IRS Free File, leading tax software providers make their online products available for free as part of a 21-year partnership with the IRS. This year, there are seven products in English and one in Spanish. Taxpayers must access these products through the IRS website.

People who make over $73,000 can use the IRS' Free File Fillable Forms. These are the electronic version of IRS paper forms. This product is best for people who are comfortable preparing their own taxes.

Qualified taxpayers can also find free one-on-one tax preparation help around the nation through the Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) programs.

5. Choose a tax professional carefully.

Most tax return preparers are professional, honest and provide excellent service to their clients. However, dishonest tax return preparers who file false income tax returns do exist. The IRS has a Directory of Federal Tax Return Preparers with Credentials and Select Qualifications and more on choosing a tax pro on IRS.gov.

6. Avoid phone delays; use online resources before calling the IRS.

To avoid waiting on hold, the IRS urges people to use IRS.gov to get answers to tax questions, check a refund status or pay taxes. There's no wait time or appointment needed — online tools and resources are available 24 hours a day. The IRS' Interactive Tax Assistant tool and Let Us Help You resources are especially helpful.

Additionally, the IRS suggests taxpayers stay up to date on important tax information online by:

Following the IRS' official social media accounts and email subscription lists to stay current on the latest tax topics and alerts.

Downloading the IRS2Go mobile app, watching IRS YouTube videos, or following the IRS on Twitter, Facebook, LinkedIn and Instagram for the latest updates on tax changes, scam alerts, initiatives, products and services.

Source: https://www.irs.gov/newsroom/key-points-to-keep-in-mind-when-filing-2022-tax-returns

US TAX, U.S. TAXKey points to keep in mind when filing 2022 tax returnsmore -

Tax basics: Understanding the difference between standard and itemized deductions

IRS Tax Tip 2023-03, January 10, 2023

One of the first decisions taxpayers must make when completing a tax return is whether to take the standard deduction or itemize their deductions. There are several factors that can influence a taxpayer's choice, including changes to their tax situation, any changes to the standard deduction amount and recent tax law changes.

Generally, most taxpayers use the option that gives them the lowest overall tax.

As taxpayers begin to think about filing their tax return, here are some things they should know about standard and itemized deductions.

Standard deduction

The standard deduction amount increases slightly every year. The standard deduction amount depends on the taxpayer's filing status, whether they are 65 or older or blind, and whether another taxpayer can claim them as a dependent. Taxpayers who are age 65 or older on the last day of the year and don't itemize deductions are entitled to a higher standard deduction.

Most filers who use Form 1040 can find their standard deduction on the first page of the form. The standard deduction for most filers of Form 1040-SR, U.S. Tax Return for Seniors, is on the last page of that form.

According to the Instructions for Form 1040 and 1040-SR, not all taxpayers can take a standard deduction, including:

A married individual filing as married filing separately whose spouse itemizes deductions - if one spouse itemizes on a separate return, both must itemize.

An individual who files a tax return for a period of less than 12 months. This is uncommon and could be due to a change in their annual accounting period.

An individual who was a nonresident alien or a dual-status alien during the year. Nonresident aliens who are married to a U.S. citizen or resident alien, however, can take the standard deduction in certain situations.

Itemized deductions

Taxpayers who choose to itemize deductions may do so by filing Schedule A (Form 1040), Itemized Deductions. Itemized deductions that taxpayers may claim can include:

State and local income or sales taxes.

Real estate and personal property taxes.

Home mortgage interest.

Personal casualty and theft losses from a federally declared disaster.

Gifts to a qualified charity.

Unreimbursed medical and dental expenses that exceed 7.5% of adjusted gross income.

Some itemized deductions, such as the deduction for taxes, may be limited. Taxpayers should review the instructions for Schedule A (Form 1040) for more information on limitations.

More information:

How Much Is My Standard Deduction?

Topic No. 551, Standard Deduction

Source: https://www.irs.gov/newsroom/tax-basics-understanding-the-difference-between-standard-and-itemized-deductions

US TAX, U.S. TAXTax basics: Understanding the difference between standard and itemized deductionsmore