All News

-

IRS revises the 2021 Child Tax Credit and Advance Child Tax Credit frequently asked questions

FAQs

Note: These FAQs supersede earlier FAQs that were posted in FS-2022-29 on May 20, 2022.

This Fact Sheet updates the 2021 Child Tax Credit and Advance Child Tax Credit frequently asked questions (FAQs). These updates are to help eligible families properly claim the credit when they prepare and file their 2021 tax return.

Q1. What are advance Child Tax Credit payments? (updated May 20, 2022)

Advance Child Tax Credit payments are early payments from the IRS of 50 percent of the estimated amount of theChild Tax Credit that you may properly claim on your 2021 tax return. If the IRS processed your 2020 tax return or 2019 tax return before the end of June 2021, these monthly payments began in July and continued through December 2021, based on the information contained in that return.

Note: Advance Child Tax Credit payment amounts were not based on the Credit for Other Dependents, which is not refundable. For more information about the Credit for Other Dependents, see IRS Schedule

8812 (Form 1040), Credits for Qualifying Children and Other Dependents.

Q2. What did I need to do to receive advance Child Tax Credit payments? (updated May 20, 2022)

Generally, nothing. If you were eligible to receive advance Child Tax Credit payments based on your 2020 tax returnor 2019 tax return (including information you entered into the Non-Filer tool for Economic Impact Payments on IRS.govin 2020, or the Child Tax Credit Non-filer Sign-up Tool in 2021), you generally received those payments automatically without needing to take any additional action.

Disbursement of advance Child Tax Credit payments began in July and continued on a monthly basis through December 2021, generally based on the information contained in your 2019 or 2020 federal income tax return. If you are eligible for the Child Tax Credit, but did not receive advance Child Tax Credit payments, you can claim the full credit amount when you file your 2021 tax return.

For more information regarding eligibility and how advance Child Tax Credit payments have been disbursed, see

Topic B: Eligibility for Advance Child Tax Credit Payments and the 2021 Child Tax Credit

and

Topic E: Advance Payment Process of the Child Tax Credit

Q3. Did I need income to receive advance Child Tax Credit payments? (updated May 20, 2022)

No. Even if you had $0 in income, you could have received advance Child Tax Credit payments if you were eligible. Disbursement of advance Child Tax Credit payments began in July and continued on a monthly basis through December 2021, generally based on the information contained in your 2019 or 2020 federal income tax return. If you are eligible for the Child Tax Credit, but did not receive advance Child Tax Credit payments, you can claim the full credit amount when you file your 2021 tax return.

For information regarding eligibility, see

Topic B: Eligibility for Advance Child Tax Credit Payments and the 2021 Child Tax Credit.

Q4. Where can I get help completing my 2021 tax return if I can’t do it myself? (updated May 20, 2022)

If you could not or chose not to use IRS Free File or Free File Fillable Forms to file your 2021 tax return, there are various types of tax return preparers, including certified public accountants,enrolled agents, attorneys, and others who can assist you in filing your return. For more information about these and other return preparers who might be right for you, visit

Need someone to prepare your tax return?

Disbursement of advance Child Tax Credit payments began in July and continued on a monthly basis through December 2021, generally based on the information contained in your 2019 or 2020 federal income tax return. If you are eligible for the Child Tax Credit, but did not receive advance Child Tax Credit payments, you can claim the full credit amount when you file your 2021 tax return.

Q5. What if I did not want to receive advance Child Tax Credit payments? (updated May 20, 2022)

If you preferred not to receive monthly advance Child Tax Credit payments because you would rather claim the full credit when you file your 2021 tax return, or you knew you were not eligible for the Child Tax Credit for your 2021 tax year, the IRS provided an option to unenroll from advance Child Tax Credit payments through the Child Tax CreditUpdate Portal (CTC UP).

Q6. When did the IRS begin disbursing advance Child Tax Credit payments? (updated January 11, 2022)

The IRS began disbursing advance Child Tax Credit payments on July 15. After that, payments were disbursed on a monthly basis through December 2021.

For more information regarding how advance Child Tax Credit payments were disbursed, see

Topic E: Advance Payment Process of the Child Tax Credit.

Q7. Did the IRS contact individuals about advance Child Tax Credit payments before they were disbursed? (updated January 11, 2022)

Yes. In June 2021, the IRS sent Letter 6417. This letter informed recipients of the amount of their estimated Child Tax Credit monthly payments. This letter also indicated where recipients could find additional information about advance Child Tax Credit payments.

Q8. How could I have qualified for advance Child Tax Credit payments? (updated May 20, 2022)

You qualified for advance Child Tax Credit payments if you had a qualifying child. Also, you — or your spouse, if married filing a joint return — must have had your main home in one of the 50 states or the District of Columbia for more than half the year. Your main home can be any location where you regularly live. Your main home may be your house, apartment, mobile home, shelter, temporary lodging, or other location and doesn’t need to be the same physicallocation throughout the taxable year. You don’t need a permanent address to get these payments. If you are temporarily away from your main home because of illness, education, business, vacation, or military service, you are generally treated as living in your main home.

Disbursement of advance Child Tax Credit payments began in July and continued on a monthly basis through December 2021, generally based on the information contained in your 2019 or 2020 federal income tax return. If you are eligible for the Child Tax Credit, but did not receive advance Child Tax Credit payments, you can claim the full credit amount when you file your 2021 tax return.

For more information regarding eligibility for advance Child Tax Credit payments, and the Child Tax Credit generally, see

Topic B: Eligibility for Advance Child Tax Credit Payments and the 2021 Child Tax Credit.

For information on how the amount of your Child Tax Credit could be reduced based on the amount of your income, see

Topic C: Calculation of the 2021 Child Tax Credit.

Q9. Will receiving advance Child Tax Credit payments cause a delay in my refund when I file my 2021 tax return? (updated May 20, 2022)

No. However, if you fail to properly reconcile your advance Child Tax Credit payments with the amount of Child Tax Credit for which you are eligible on your 2021 federal income tax return, processing of your return by the IRS will be delayed.

For more information regarding how to reconcile your advance Child Tax Credit payments with your Child Tax Credit on your 2021 tax return, see

Topic H: Reconciling Your Advance Child Tax Credit Payments on Your 2021 Tax Return.

Q10. Are advance Child Tax Credit payments taxable? (updated May 20, 2022)

No. Advance Child Tax Credit payments are not income and will not be reported as income on your 2021 tax return. Advance Child Tax Credit payments are advance payments of your tax year 2021 Child Tax Credit.

However, the total amount of advance Child Tax Credit payments that you received during 2021 was based on the IRS’s estimate of your 2021 Child Tax Credit. If the total of your advance Child Tax Credit payments is greater than the Child Tax Credit amount that you are allowed to claim on your 2021 tax return, you may have to repay the excess amount on your 2021 tax return. For example, if you received advance Child Tax Credit payments for two qualifying children properly claimed on your 2020 tax return, but you no longer have qualifying children in 2021,the advance Child Tax Credit payments that you received based on those children are added to your 2021 income tax unless you qualify for repayment protection. For more information regarding your eligibility for repayment protection, and how to reconcile your advance Child Tax Credit payments with your Child Tax Credit on your 2021 tax return, see

Topic H: Reconciling Your Advance Child Tax Credit Payments on Your 2021 Tax Return.

Q11. Will the IRS send me a letter about my advance Child Tax Credit payments to help me claim the correct Child Tax Credit amount on my 2021 return during the 2022 tax filing season? (updated May 20, 2022)

Yes. In January 2022, the IRS sent Letter 6419 to provide the total amount of advance Child Tax Credit payments that were disbursed to you during 2021. Please keep this letter regarding your advance Child Tax Credit payments with your tax records. You may need to refer to this letter when you file your 2021 tax return.

For more information regarding this letter and how to reconcile your advance Child Tax Credit payments with your Child Tax Credit on your 2021 return, see

Topic H: Reconciling Your Advance Child Tax Credit Payments on Your 2021 Tax Return.

Q12. Will advance Child Tax Credit payments affect any government benefits that I receive? (updated January 11, 2022)

No. Advance Child Tax Credit payments cannot be counted as income when determining if you or anyone else is eligible for benefits or assistance, or how much you or anyone else can receive, under any federal program or under any state or local program financed in whole or in part with federal funds. These programs also cannot count advance Child Tax Credit payments as a resource for purposes of determining eligibility for at least 12 months after you receive them.

Q A13. Can I call the IRS or my tax software company or bank to update my bank account information for advance Child Tax Credit payments? (updated May 20, 2022)

The IRS launched on IRS.gov a Child Tax Credit Update Portal (CTC UP), which allowed you to update informationwith the IRS. The portal is no longer available, and the IRS has completed disbursing advance Child Tax Credit payments.

If you file a 2021 return, the IRS will use the bank account information you enter on your tax return to send your refund, if you are receiving one.

Q14. How do I avoid scams relating to advance Child Tax Credit payments? (updated May 20, 2022)

The IRS has urged everyone to be on the lookout for scam artists trying to use advance Child Tax Credit payments or the Child Tax Credit as a cover for schemes to steal personal information and money. The IRS doesn't initiate contact by email, text messages, or social media channels to request personal or financial information – even information related to advanceChild Tax Credit payments. Also, watch out for emails with attachments or links claiming to have special information about advance Child Tax Credit payments or refunds of the Child Tax Credit.

If you receive a suspicious IRS-related email, see

Report Phishing and Online Scams for additional information.

Q15. I want to help spread the news about the Child Tax Credit within my community. How can I do that? (updated May 20, 2022)

The IRS has materials and information that can be easily shared by social media, email, and other methods. The IRS urges employers, community groups, non-profits, associations, education groups, and anyone else with connections to people with children to share information about the Child Tax Creditexpansions for the 2021 tax year. You can find materials to share at

2021 Child Tax Credit and Advance Child Tax Credit Payments: Resources and Guidance

.

The IRS will continue to provide materials on how to claim the 2021 Child Tax Credit, as well as how to reconcile your advance Child Tax Credit payments with the amount of 2021 Child Tax Credit forwhich you are eligible. For more information regarding how to reconcile your advance Child Tax Credit payments with your Child Tax Credit on your 2021 tax return, see

Topic H: Reconciling Your Advance Child Tax Credit Payments on Your 2021 Tax Return.

Disbursement of advance Child Tax Credit payments began in July and continued on a monthly basis through December 2021, generally based on the information contained in your 2019 or 2020 federal income tax return. If you are eligible for the Child Tax Credit, but did not receive advance Child Tax Credit payments, you can claim the full credit amount when you file your 2021 tax return.

Q16. When was I able to update my information? (updated May 20, 2022)

Updates made by 11:59 pm Eastern Time on November 29 were reflected in the monthly payment disbursed in December. Updates to the number of qualifying children or filing status should be made when you file your 2021 tax return

2021 Monthly deadlines to make changes to your information

Date You Can Make Changes

What You Can Do

June 21, 2021

• Find out if you’re eligible

• Unenroll from payments

• See a list of your payments

June 30, 2021

• Make changes to your bank information

August 20, 2021

• Make changes to your address

November 1, 2021

• Make changes to your income

November 29, 2021

• Final date to update information on Child Tax Credit Update Portal to impact advance Child Tax Credit payments disbursed in December.

• Child Tax Credit Update Portal available in Spanish

Source: https://www.irs.gov/pub/taxpros/fs-2022-32.pdf

US TAX, U.S. TAX

IRS revises the 2021 Child Tax Credit and Advance Child Tax Credit frequently asked questionsmore -

IRS continues work on inventory of tax returns; original tax returns filed in 2021 to be completed this week

IR-2022-128, June 21, 2022

WASHINGTON — Following intensive work during the past several months, the Internal Revenue Service announced today that processing on a key group of individual tax returns filed during 2021 will be completed by the end of this week.

Due to issues related to the pandemic and staffing limitations, the IRS began 2022 with a larger than usual inventory of paper tax returns and correspondence filed during 2021. The IRS took a number of steps to address this, and the agency is on track to complete processing of originally filed Form 1040 (individual tax returns without errors) received in 2021 this week.

Business paper returns filed in 2021 will follow shortly after. The IRS continues to work on the few remaining 2021 individual tax returns that have processing issues or require additional information from the taxpayer.

As of June 10, the IRS had processed more than 4.5 million of the more than 4.7 million individual paper tax returns received in 2021. The IRS has also successfully processed the vast majority of tax returns filed this year: More than 143 million returns have been processed overall, with almost 98 million refunds worth more than $298 billion being issued.

IRS employees continue working hard to process these and other tax returns filed in the order received. The IRS continues to receive current and prior-year individual returns and related correspondence as people file extensions, amended returns and a variety of business tax returns.

To date, more than twice as many returns await processing compared to a typical year at this point in the calendar year, although the IRS has worked through almost a million more returns to date than it had at this time last year. And a greater percentage of this year's inventory awaiting processing is comprised of original returns which, generally, take less time to process than amended returns.

To work to address the unprocessed inventory by the end of this year, the IRS has taken aggressive, unprecedented steps to accelerate this important processing work while maintaining accuracy. This effort included significant, ongoing overtime for staff throughout 2022, creating special teams of employees focused solely on processing aged inventory, and expediting hiring of thousands of new workers and contractors to help with this ongoing effort.

Additionally, the IRS has greatly improved the process for taxpayers whose paper and electronically filed returns were suspended during processing for manual review and correction – referred to as error resolution. Last filing season, an IRS tax examiner could correct an average of 70 tax returns with errors per hour. Thanks to new technology implemented this filing season, 180 to 240 returns can now be corrected per hour. As of June 12, 2021, there were 8.9 million tax returns in error resolution. As of June 10, 2022, there were just 360,000 returns awaiting correction.

The IRS will continue its intense effort to make progress on processing these paper returns in the months ahead.

Source:https://www.irs.gov/newsroom/irs-continues-work-on-inventory-of-tax-returns-original-tax-returns-filed-in-2021-to-be-completed-this-week

US TAX, U.S. TAXIRS continues work on inventory of tax returns; original tax returns filed in 2021 to be completed this weekmore -

Questions and Answers about the Third-round Economic Impact Payment

These updated FAQs were released to the public in Fact Sheet 2022-22PDF, March 25, 2022.

If you didn't receive, or get the full amount of, the third-round Economic Impact Payment, you may be eligible to claim the 2021 Recovery Rebate Credit and must file a 2021 tax return – even if you don't usually file taxes – to claim it. Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund.

If your income is $73,000 or less, you can file your federal tax return electronically for free through the IRS Free File Program. The fastest and most secure way to get your tax refund is to file electronically and have it direct deposited, contactless and free, into your financial account. You can have your refund direct deposited into your bank account, prepaid debit card, or mobile app, and will need to provide routing and account numbers.

If you didn't get the full amounts of the first- and second-round Economic Impact Payments, you may be eligible to claim the 2020 Recovery Rebate Credit and must file a 2020 tax return – even if you don't usually file taxes – to claim it. DO NOT include any information regarding the first- and second-round Economic Impact Payments or the 2020 Recovery Rebate Credit on your 2021 return.

Below are links to the frequently asked questions about the third-round Economic Impact Payment, separated by topic. Please do not call the IRS. Our phone assistors don't have information beyond what's available on IRS.gov.

The Third-round Economic Impact Payment was authorized by the American Rescue Plan Act of 2021 as an advance payment of the 2021 Recovery Rebate Credit.

The IRS started sending the third-round Economic Impact Payments to eligible individuals in March 2021 and continued sending payments throughout the year as tax returns were processed.

The IRS has issued all third-round Economic Impact Payments (including all plus-up payments).

Families and individuals in the following circumstances, among others, may not have received the full amount of their third-round Economic Impact Payment because their circumstances in 2021 were different than they were in 2020. These families and individuals may be eligible to receive more money by claiming the 2021 Recovery Rebate Credit on their 2021 income tax return:

Parents of a child born in 2021 who claim the child as a dependent on their 2021 income tax return may be eligible to receive a 2021 Recovery Rebate Credit of up to $1,400 for this child.

All eligible parents of qualifying children born or welcomed through adoption or foster care in 2021 are also encouraged to claim the child tax credit — worth up to $3,600 per child born in 2021 — on their 2021 income tax return.

Families who added a dependent – such as a parent, a nephew or niece, or a grandchild – on their 2021 income tax return who was not listed as a dependent on their 2020 income tax return may be eligible to receive a 2021 Recovery Rebate Credit of up to $1,400 for this dependent.

Single filers who had incomes above $80,000 in 2020 but less than this amount in 2021; married couples who filed a joint return and had incomes above $160,000 in 2020 but less than this amount in 2021; and head of household filers who had incomes above $120,000 in 2020 but less than this amount in 2021 may be eligible for a 2021 Recovery Rebate Credit of up to $1,400 per person.

Single filers who had incomes between $75,000 and $80,000 in 2020 but had lower incomes in 2021; married couples who filed a joint return and had incomes between $150,000 and $160,000 in 2020 but had lower incomes in 2021; and head of household filers who had incomes between $112,500 and $120,000 in 2020 but had lower incomes in 2021 may be eligible for a 2021 Recovery Rebate Credit.

Individuals must claim the 2021 Recovery Rebate Credit on their 2021 income tax return in order to get this money; the IRS will not automatically calculate the 2021 Recovery Rebate Credit. The IRS began accepting 2021 income tax returns on January 24.

Most other eligible people already received the full amount of their credit in advance and don't need to include any information about this payment when they file their 2021 tax return.

Topic A: General Information

Topic B: Eligibility and Calculation of the Third Payment

Topic C: Plus-Up Payments

Topic D: EIP Cards

Topic E: Requesting My Payment

Topic F: Social Security, Railroad Retirement and Department of Veterans Affairs benefit recipients

Topic G: Receiving My Payment

Topic H: Reconciling on Your 2021 Tax Return

Topic I: Returning the Third-round Economic Impact Payment

Topic J: Payment Issued but Lost, Stolen, Destroyed or Not Received

Source:https://www.irs.gov/newsroom/questions-and-answers-about-the-third-round-economic-impact-payment

US TAX, U.S. TAXQuestions and Answers about the Third-round Economic Impact Paymentmore -

Low Income Taxpayer Clinic 2023 grant application period now open – National Taxpayer Advocate calls for applicants looking to serve their communities and uphold taxpayer rights

Low Income Taxpayer Clinic 2023 grant application period now open – National Taxpayer Advocate calls for applicants looking to serve their communities and uphold taxpayer rightsLow Income Taxpayer Clinic 2023 grant application period now open – National Taxpayer Advocate calls for applicants looking to serve their communities and uphold taxpayer rightsmore -

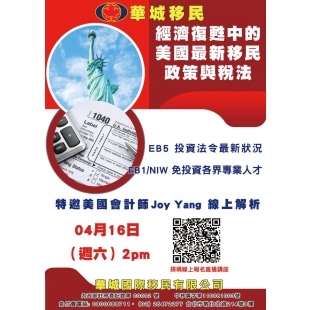

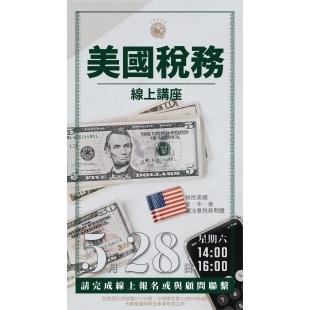

May. 28 Metropolitan Immigration Consulting Group Seminar

May 28 Metropolitan Immigration Consulting Group Seminar, Joy Yang is the only accountant be invited.May. 28 Metropolitan Immigration Consulting Group Seminarmore -

IRS announces 2022 funding for Low Income Taxpayer Clinic grant recipients

IRS announces 2022 funding for Low Income Taxpayer Clinic grant recipientsIRS announces 2022 funding for Low Income Taxpayer Clinic grant recipientsmore -

Taxpayers who owe and missed the April 18 filing deadline should file now to limit penalties and interest; not too late to claim the Child Tax Credit for 2021

Taxpayers who owe and missed the April 18 filing deadline should file now to limit penalties and interest; not too late to claim the Child Tax Credit for 2021Taxpayers who owe and missed the April 18 filing deadline should file now to limit penalties and interest; not too late to claim the Child Tax Credit for 2021more -

2021 return done? Next step: use the IRS Tax Withholding Estimator to make sure withholding is right for 2022

The Internal Revenue Service today urged any taxpayer, now finishing up their 2021 tax return, to use the IRS Tax Withholding Estimator to make sure they're having the right amount of tax taken out of their pay during 2022.

This online tool offers workers, self-employed individuals and retirees who have wage income a user-friendly resource for effectively tailoring the amount of income tax withheld from wages.

2021 refund too big? Too small? Surprise tax bill? If any of these apply, the Tax Withholding Estimator can help anyone make sure it doesn't happen again by having the right amount of taxes taken out for 2022.

Benefits of using the Estimator

For employees, withholding is the amount of federal income tax taken out of their paycheck. Taxpayers can use the results from the Tax Withholding Estimator to determine if they should complete a new Form W-4 and submit it to their employer. For example, checking withholding can:

Ensure the right amount of tax is withheld and prevent an unexpected tax bill or penalty at tax time and

Determine whether to have less tax withheld up front, thereby boosting take-home pay and reducing any refund at tax time.

When should taxpayers use this tool?

The IRS recommends checking withholding at least once a year. For anyone who has just finished filling out their 2021 return, now is a particularly good time to do it. It's also a good idea to use this tool right after a major life change, such as marriage, divorce, home purchase or the birth or adoption of a child.

What records are needed?

The Tax Withholding Estimator's results are only as accurate as the information entered. To help prepare, the IRS recommends that taxpayers gather:

Their most recent pay statements and if married, for their spouse,

Information for other sources of income and

Their most recent income tax return, 2021, if possible.

While the Tax Withholding Estimator works for most taxpayers, people with more complex tax situations should instead use the instructions in Publication 505, Tax Withholding and Estimated Tax. This includes taxpayers who owe alternative minimum tax or certain other taxes, and people with long-term capital gains or qualified dividends.

Still working on a 2021 return?

The IRS urges anyone still working on their 2021 return to make sure they have all their year-end statements in hand before filing. Besides all W-2s and 1099s, this includes two new letters issued by the IRS.

People who received advance payments of the Child Tax Credit will need to reconcile, or compare, the total received in advance with the amount they're eligible to claim. Letter 6419 shows their total advance Child Tax Credit payments to help taxpayers reconcile and receive the full amount of the 2021 Child Tax Credit.

While most eligible people already received their stimulus payments, people who are missing a third stimulus payment or got less than the full amount may be eligible to claim a Recovery Rebate Credit on their 2021 federal tax return. Letter 6475 shows their total third round of Economic Impact Payments.

Alternatively, anyone can securely sign in to their Online Account to access information on their advance Child Tax Credit payments and Economic Impact Payments.

Taxpayers should also e-file and choose direct deposit to avoid processing delays and help with faster delivery of their refund.

For most Americans, the tax-filing deadline is April 18, 2022. For residents of Maine and Massachusetts, the deadline is April 19, 2022. Americans who live and work abroad have until June 15, 2022. Those who need more time to file can get an automatic extension to file until Oct. 17, 2022. These extensions don't change the April 18 payment deadline. It is not an extension to pay. More information is available at IRS.gov.

Source: https://www.irs.gov/newsroom/2021-return-done-next-step-use-the-irs-tax-withholding-estimator-to-make-sure-withholding-is-right-for-2022

US TAX, U.S. TAX2021 return done? Next step: use the IRS Tax Withholding Estimator to make sure withholding is right for 2022more -

IRS dispels new and common myths about tax refunds; key information available to help people

IRS dispels new and common myths about tax refunds; key information available to help peopleIRS dispels new and common myths about tax refunds; key information available to help peoplemore -

IRS letters going out to taxpayers who may need to take action related to Qualified Opportunity Funds

IRS letters going out to taxpayers who may need to take action related to Qualified Opportunity FundsIRS letters going out to taxpayers who may need to take action related to Qualified Opportunity Fundsmore -

Options for taxpayers who need help paying their tax bill

Options for taxpayers who need help paying their tax billOptions for taxpayers who need help paying their tax billmore